It has been announced that $GCAKE has conducted buybacks and burns worth $10,000,000, with the number of burns at the end of April to be announced in May. However, the total number of burns has already exceeded 300 billion. $GCAKE will continue to carry out buybacks and burns in the future.

GCAKE’s Buy Back & Burn?

Numerous tokens released in recent years have been structured with an inflationary model that may result in selling pressure both in the short and long run. In this regard, $GCAKE distinguishes itself with a unique burn mechanism that aims to promote deflation, a crucial feature.

What is Buy Back & Burn?

The buyback and burn strategy is designed to enhance the value of a token and stabilize its price by decreasing the total supply and increasing its scarcity. As a result of this reduction, the demand for the token in the secondary market becomes higher, leading to increased liquidity and decreased price volatility. This approach particularly appeals to long-term growth investors, who are encouraged to hold onto the token, thus contributing to its price stability.

What is the difference between buyback and burn token

Buyback and burn tokens are two distinct concepts that serve the same purpose of increasing the value of a token by limiting its supply in the market. Buyback refers to a project or corporation using its cash resources to repurchase some of its tokens or shares from holders at market price. During the buyback process, the repurchased assets are held in the entity’s wallets rather than being destroyed. On the other hand, burning tokens involves destroying a certain number of tokens to reduce the supply in circulation and artificially boost its demand. Burning achieves the same objective as a buyback, but it does not necessarily increase the token’s price. Therefore, token issuers use a combination of both called ‘buyback-and-burn.’

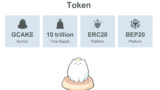

More details about $GCAKE, please check the post below.